Shielding Your Identity: Top 10 Identity Theft Protection Services

In a world where personal identities are now more interconnected than ever before, the risk of identity theft has dramatically escalated. Today, malicious cyber actors are finding more innovative ways to exploit our personal information, leading to dire consequences. Thus, it has become critical to protect one's identity; cue identity theft protection services. These services securely monitor personal and financial information, provide theft alerts, and assist in recovery, thereby safeguarding one's digital presence. In this article, we dive into the realm of identity protection to present the ten best services to ensure your online persona remains exclusively yours.

1. Aura: Your Digital Bodyguard

Aura distinguishes itself as one of the leading identity theft protection companies by offering comprehensive digital security. As technology evolves, the risks of identity theft escalate, and Aura's approach adapts to these changes accordingly. With its three-fold protection system encompassing identity, financials, and personal devices, Aura provides extensive coverage. It actively monitors your information online, provides credit report updates, and offers immediate alerts in case of potential threats. Adding to its allure, Aura's user-friendly interface and 24/7 customer support make it an appealing option.

2. IdentityForce: Power-Packed Protection

IdentityForce excels in its thorough nature of protection and the promptness of its alerts. Offering both credit and identity protection, it provides a comprehensive view of your personal security landscape. It actively monitors court records, change of address, payday loans, and even sex offender registries. Moreover, with its social media and identity fraud restoration features, it is the standing guard you need in an increasingly interconnected world. In essence, IdentityForce is a powerful tool that's impressive in its all-around performance.

3. Identity Guard: AI-Augmented Security

Identity Guard stands out with its use of artificial intelligence. Leveraging IBM Watson, it analyzes your digital presence and predicts potential threats ahead of time. This service extends from monitoring credit changes to scanning dark web activities. Further, its safe browsing tool ensures protection while accessing financial sites. Additionally, it offers a mobile app that delivers real-time alerts and provides a user-friendly way of keeping track of your identity’s safety.

4. LifeLock: Norton-Powered Network Security

LifeLock's reputation precedes itself, and with a partnership with Norton, it brings an excellent blend of identity theft protection and network security. LifeLock highlights include SSN, credit, and home title theft monitoring. Its advanced plans also include Norton antivirus protection, VPN for online privacy, parental control, and much more. With its focus on preemptive protection, LifeLock prepares you for threats before they can harm you, providing layers of security often unseen in other companies.

5. IdentityIQ: Visual-Centric Approach

IdentityIQ differentiates itself with a visually focused approach. Its credit scores and report features are color-coded and easy to navigate. It provides notifications in credit changes and dark web activities, coupled with up to $1 million in identity theft insurance. Beyond this, IdentityIQ delivers value-added services like family protection, opt-out junk mail, and discounted extra reports. It's an excellent service if you appreciate a visually intuitive interface plus comprehensive services.

6. IDShield: Family First Focus

IDShield’s standout feature is its family plan. It allows you to extend its comprehensive identity theft protection services to your spouse and up to 10 children at an affordable price. IDShield continuously scans for abnormal, potentially dangerous activity involving your identity, investment accounts, credit cards, social networks, etc. Support includes access to licensed private investigators for personalized advice and assistance. The service’s focus on family protection makes it an outstanding choice for those wanting to secure their loved ones all at once.

7. Zander: Budget-Friendly Decoy

Zander offers identity theft protection that's particularly noteworthy for those on a budget. Despite the affordable plans, Zander covers all bases, from credit monitoring to social security number protection. Its recovery services promise to be proactive should a breach occur, devoting both time and resources to restore your identity. Its primary mission, however, is prevention via education, making you an informed customer less likely to become prey to identity fraudsters.

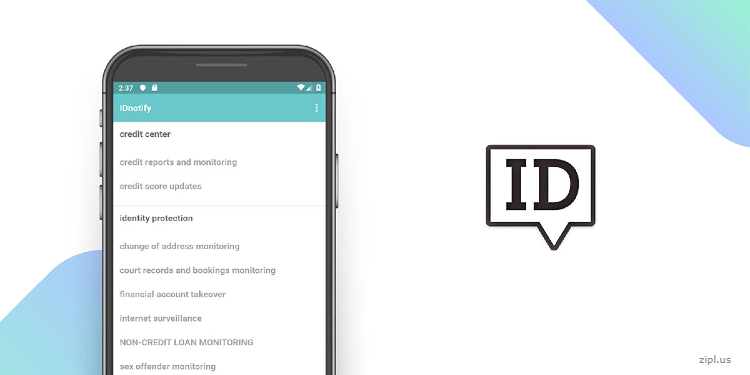

8. IDNotify: Personalized Plans

IDNotify allows you to customize your plan based on personal needs and budget. It offers core features like credit monitoring, internet surveillance, and financial account alerts. Its advanced plan also includes court records and credit card monitoring. IDNotify’s customer service is well-regarded for its attention to client needs, completing a well-rounded identity protection network that's tailor-made for you.

9. ID Watchdog: Employee-Benefit Champion

ID Watchdog excels in its offering as an identity theft protection service provided by employers as an employee benefit. Comprehensive credit and identity monitoring, advanced identity theft resolution services, and impressive customer service make it a reliable choice. Moreover, its service continues even if the employee leaves, retires, or is terminated. This feature fits nicely in an employment benefits package, making it unique in the identity theft protection arena.

10. PrivacyGuard: Credit Report Central

PrivacyGuard rounds our list with one primary focus: credit reports. PrivacyGuard provides monthly triple-bureau credit scores and reports, a feature unique to this service. Alongside credit monitoring, it also offers protection against identity theft and a secure keyboard & browser to carry out online banking. Coupled with its credit simulator tool, it's an impressive service for credit-focused consumers.

Selecting the best identity theft protection service depends largely on personal needs, family size, and budget considerations. Understanding the unique features that these services offer can be critical in making the right choice. Regardless of choice, having an identity theft protection service provides peace of mind, knowing that an ally is looking out for you in an increasingly digital - and risky - world.

0 Comments

Your comment is awaiting moderation. We save your draft here